The Feie Calculator Ideas

The Best Guide To Feie Calculator

Table of ContentsThe Main Principles Of Feie Calculator Feie Calculator Things To Know Before You BuyFeie Calculator for DummiesFeie Calculator Can Be Fun For EveryoneHow Feie Calculator can Save You Time, Stress, and Money.Not known Incorrect Statements About Feie Calculator More About Feie Calculator

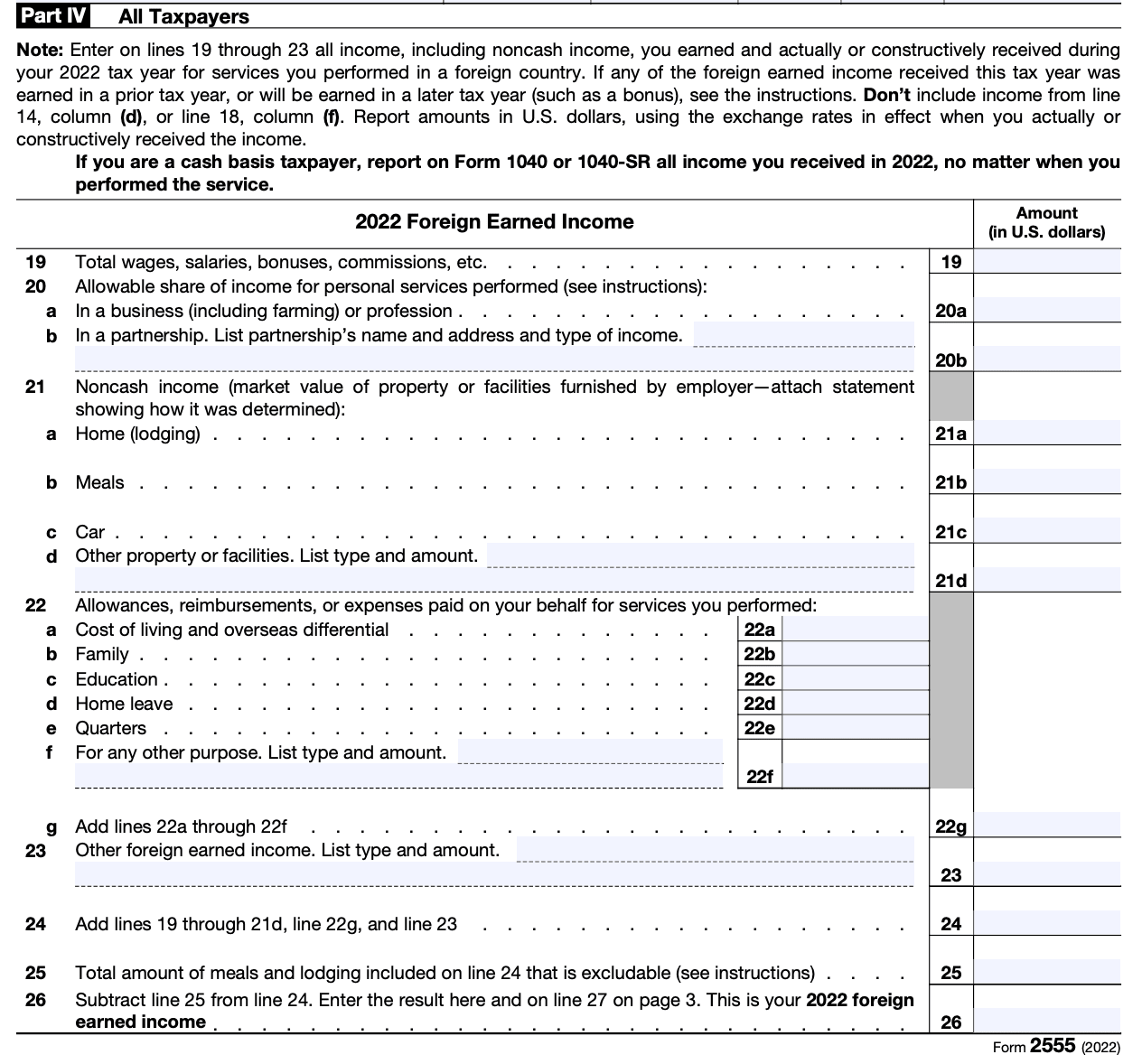

If he 'd frequently taken a trip, he would rather finish Part III, noting the 12-month period he fulfilled the Physical Existence Examination and his traveling history - Digital Nomad. Step 3: Coverage Foreign Income (Part IV): Mark made 4,500 each month (54,000 yearly). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its worth is likewise included.Mark computes the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Given that he resided in Germany all year, the portion of time he lived abroad during the tax is 100% and he goes into $59,400 as his FEIE. Ultimately, Mark reports complete earnings on his Type 1040 and goes into the FEIE as an unfavorable quantity on Set up 1, Line 8d, decreasing his gross income.

Picking the FEIE when it's not the very best option: The FEIE may not be suitable if you have a high unearned earnings, earn more than the exclusion restriction, or live in a high-tax nation where the Foreign Tax Obligation Credit Scores (FTC) may be a lot more useful. The Foreign Tax Credit Report (FTC) is a tax decrease method often utilized in conjunction with the FEIE.

See This Report about Feie Calculator

deportees to counter their united state tax financial debt with foreign income taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax nations, the FTC can usually eliminate U.S. tax obligation financial obligation completely. Nonetheless, the FTC has limitations on qualified taxes and the optimum insurance claim amount: Qualified tax obligations: Only earnings taxes (or taxes instead of earnings taxes) paid to foreign federal governments are eligible.

tax obligation obligation on your foreign revenue. If the foreign taxes you paid surpass this restriction, the excess foreign tax obligation can normally be lugged ahead for as much as ten years or returned one year (via a modified return). Preserving accurate records of international revenue and taxes paid is therefore crucial to determining the right FTC and preserving tax conformity.

migrants to lower their tax obligation obligations. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can omit up to $130,000 using the FEIE (2025 ). The staying $120,000 might then be subject to taxes, but the U.S. taxpayer can potentially use the Foreign Tax Credit score to counter the taxes paid to the foreign country.

Feie Calculator - The Facts

He offered his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his wife to help accomplish the Bona Fide Residency Examination. Neil points out that acquiring property abroad can be challenging without very first experiencing the place.

"It's something that individuals need to be actually thorough concerning," he says, and encourages deportees to be careful of usual mistakes, such as overstaying in the United state

Neil is careful to stress to U.S. tax authorities that "I'm not conducting any performing any kind of Company. The U.S. is one of the couple of countries that taxes its residents no matter of where they live, meaning that even if an expat has no income from U.S.

How Feie Calculator can Save You Time, Stress, and Money.

tax return. "The Foreign Tax obligation Debt permits people working in high-tax countries like the UK to counter their U.S. tax responsibility by the quantity they've currently paid in tax obligations abroad," says Lewis.

The possibility of lower living costs can be tempting, however it often features trade-offs that aren't immediately noticeable - https://feie-calculator.jimdosite.com/. Housing, for instance, can be more budget friendly in some countries, yet this can imply endangering on facilities, security, or access to trusted energies and solutions. Low-cost residential properties may be found in locations with inconsistent internet, limited public transport, or unreliable health care facilitiesfactors that can considerably impact your daily life

Below are some of the most often asked inquiries regarding the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) enables united state taxpayers to leave out approximately $130,000 of foreign-earned earnings from federal revenue tax obligation, minimizing their united state tax obligation liability. To certify for FEIE, you must meet either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Examination (verify your key residence in a foreign nation for an entire tax obligation year).

The Physical Visibility Examination also calls for United state taxpayers to have both a foreign earnings and an international tax obligation home.

The Ultimate Guide To Feie Calculator

An earnings tax obligation treaty in between the united state and an additional country can help avoid double taxation. While the Foreign Earned Earnings Exclusion decreases gross income, a treaty may give added benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare united state residents with over $10,000 in international financial accounts.

Neil Johnson, CPA, is a tax advisor on the Harness system and the owner of The Tax obligation Dude. He has more than thirty years of experience and now specializes in CFO solutions, equity compensation, copyright taxation, marijuana taxes and divorce associated tax/financial preparation matters. He is a deportee based in Mexico.

The international gained income exclusions, in some cases described as the Sec. 911 exemptions, leave out tax on earnings gained from functioning abroad. The exclusions comprise 2 components - an income exemption and a housing exemption. The following Frequently asked questions discuss the advantage of the exclusions including official site when both spouses are deportees in a general way.

Some Known Facts About Feie Calculator.

The tax advantage excludes the revenue from tax at bottom tax obligation rates. Formerly, the exemptions "came off the top" reducing earnings subject to tax at the top tax obligation rates.

These exemptions do not exempt the incomes from United States tax however merely provide a tax obligation reduction. Note that a single individual working abroad for every one of 2025 who earned regarding $145,000 without various other income will certainly have taxed income reduced to absolutely no - efficiently the very same solution as being "free of tax." The exclusions are computed each day.

If you attended company meetings or workshops in the US while living abroad, revenue for those days can not be excluded. Your earnings can be paid in the US or abroad. Your company's area or the location where wages are paid are not aspects in certifying for the exclusions. Physical Presence Test for FEIE. No. For US tax it does not matter where you keep your funds - you are taxable on your globally income as a United States person.